Tax-Efficient Distributions

A significant benefit of Gray Harbor Government Income REIT’s Investment Strategy is its tax-efficiency. Since the launch of the strategy, 100% of all distributions made have been classified as return of capital for income tax purposes. This classification is clearly specified on the 1099-DIVS tax forms investors receive. Because of this, all investors have recognized a maximum tax rate of 0.00%.

Return of capital is only available to the extent an investor has sufficient tax basis.

Return of Capital by Year (%)

| Form 1099-DIV Box | 1a | 1b | 2a | 3a |

|---|---|---|---|---|

| Year | Total Ordinary Dividends | Qualified Dividends | Total Capital Gains Distrbuted | 199A Dividends Distributions (Return of Capital) |

| 2023 | - | - | - | 100% |

| 2022 | - | - | - | 100% |

| 2021 | - | - | - | 100% |

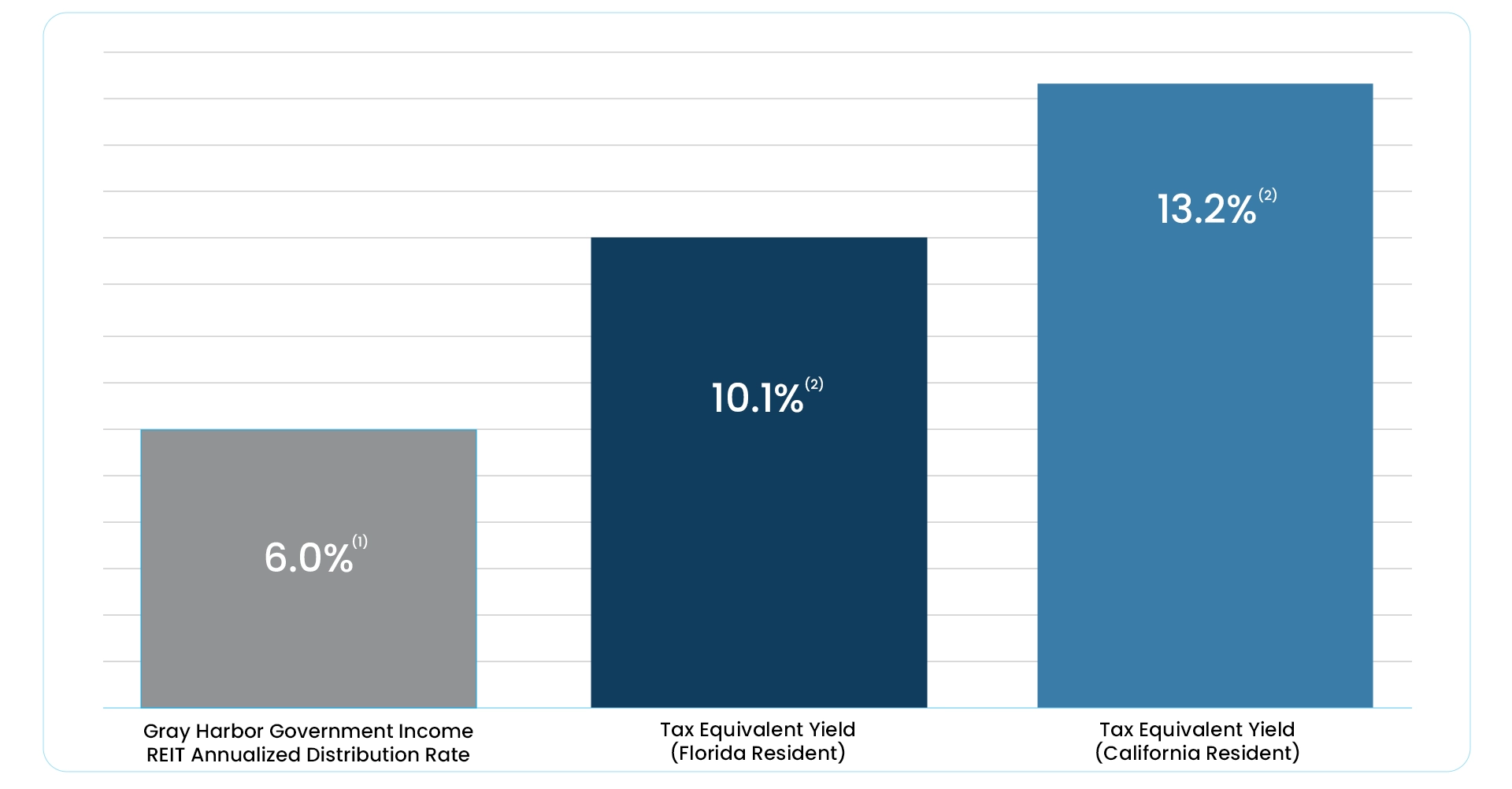

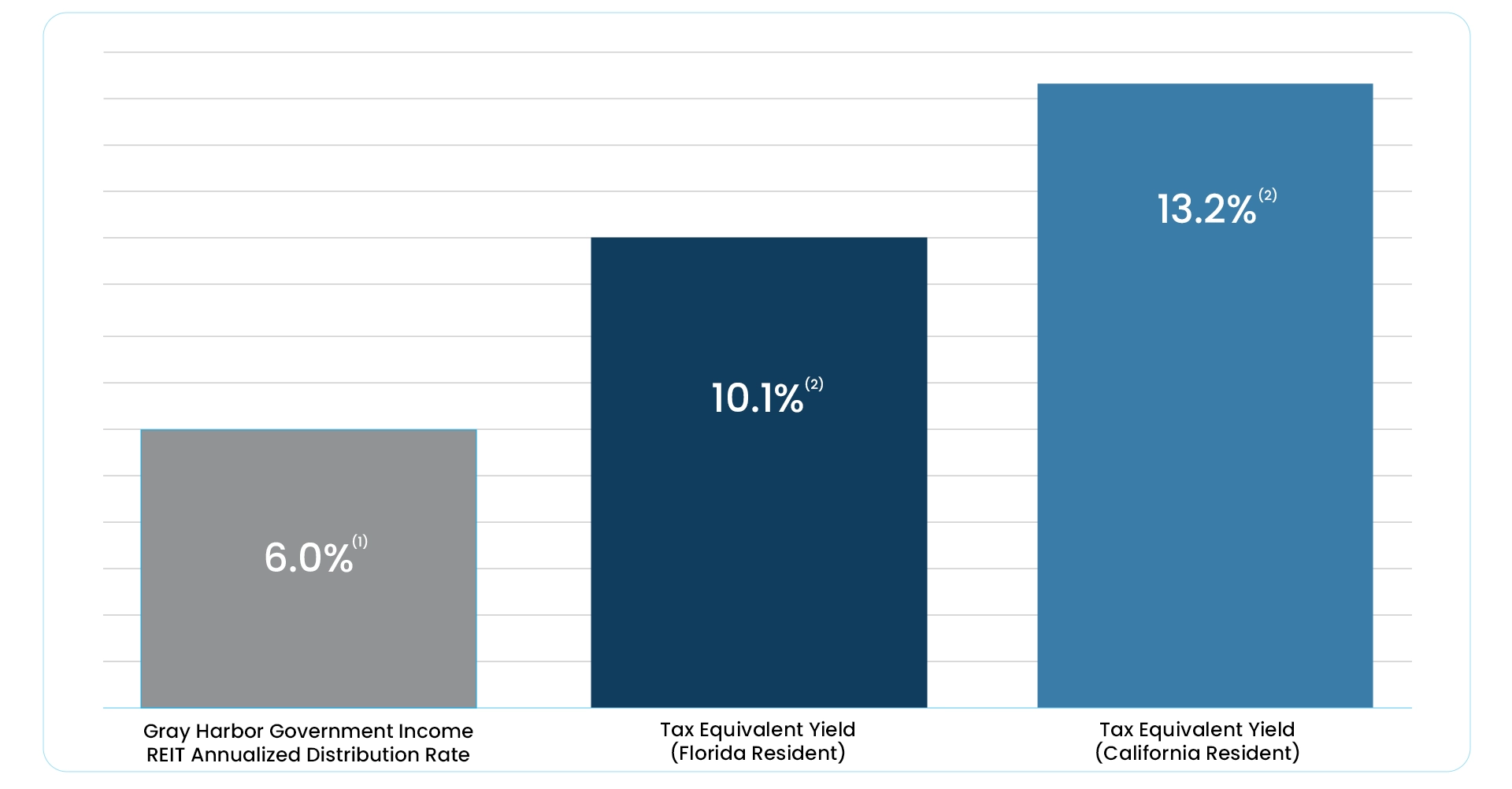

Gray Harbor Government Income REIT Annualized Yield

(1) Reflects the current month’s distribution annualized and divided by the prior month’s net asset value, which is inclusive of all fees and expenses. Distributions are not guaranteed and may be funded from the sources other than cash flow from operations.

(2) 100% of Gray Harbor Capital Government Income REIT’s dividend distributions since inception have been paid as return of capital. Each individual’s tax situation varies. Please seek guidance from a tax advisor. The information presented here should not be construed as investment, legal or tax advice. Return of capital distributions reduce an investor’s basis in the year received, and generally defer tax liabilities until the underlying position is sold. Items such as depreciation and amortization, which are non-cash items, can reduce taxable income for investors in the Gray Harbor Capital Government Income REIT. The Tax Equivalent Yield shown assumes a Florida investor who is currently invested in Gray Harbor Capital Government Income REIT with a maximum federal income tax rate of 37%. While Gray Harbor Capital Government Income REIT’s current distributions are all classified as return of capital, there is no assurance or guarantee that this classification will continue in future time periods and 0% state income tax rate” to “and 0% state income tax rate, net investment income tax of 3.8%, and 0% state income tax rate and a California investor who is currently invested in the Gray Harbor Government Income REIT with a maximum federal income tax rate of 37%, net investment income tax of 3.8%, and 14.4% state income tax rate

Tax-Efficient Distributions

A significant benefit of Gray Harbor Government Income REIT’s Investment Strategy is its tax-efficiency. Since the launch of the strategy, 100% of all distributions made have been classified as return of capital for income tax purposes. This classification is clearly specified on the 1099-DIVS tax forms investors receive. Because of this, all investors have recognized a maximum tax rate of 0.00%.

Return of capital is only available to the extent an investor has sufficient tax basis.

Return of Capital by Year (%)

Form 1099-DIV Box

2023

Total Ordinary Dividends

–

199A Dividends Distributions

(Return of Capital)

100%

Form 1099-DIV Box

2022

Total Ordinary Dividends

–

199A Dividends Distributions

(Return of Capital)

100%

Form 1099-DIV Box

2021

Total Ordinary Dividends

–

199A Dividends Distributions

(Return of Capital)

100%

Tax Equivalent Yield

(1) Reflects the current month’s distribution annualized and divided by the prior month’s net asset value, which is inclusive of all fees and expenses. Distributions are not guaranteed and may be funded from the sources other than cash flow from operations.

(2) 100% of Gray Harbor Capital Government Income REIT’s dividend distributions since inception have been paid as return of capital. Each individual’s tax situation varies. Please seek guidance from a tax advisor. The information presented here should not be construed as investment, legal or tax advice. Return of capital distributions reduce an investor’s basis in the year received, and generally defer tax liabilities until the underlying position is sold. Items such as depreciation and amortization, which are non-cash items, can reduce taxable income for investors in the Gray Harbor Capital Government Income REIT. The Tax Equivalent Yield shown assumes a Florida investor who is currently invested in Gray Harbor Capital Government Income REIT with a maximum federal income tax rate of 37%. While Gray Harbor Capital Government Income REIT’s current distributions are all classified as return of capital, there is no assurance or guarantee that this classification will continue in future time periods and 0% state income tax rate” to “and 0% state income tax rate, net investment income tax of 3.8%, and 0% state income tax rate and a California investor who is currently invested in the Gray Harbor Government Income REIT with a maximum federal income tax rate of 37%, net investment income tax of 3.8%, and 14.4% state income tax rate