Tax-Efficient Distributions (1)

A significant benefit of Gray Harbor Government Income REIT’s Investment Strategy is its tax-efficiency. Since the launch of the strategy, 100% of all distributions have been classified as return of capital for income tax purposes. This classification is specified in box 3 of the 1099-DIVS tax forms investors receive. Because of this, all investors have recognized a maximum tax rate of 0.00% on distributions to date.

Return of Capital as % of Total Distributions by Year (1)

| Form 1099-DIV Box | 1a | 1b | 2a | 3 |

|---|---|---|---|---|

| Year | Total ordinary dividends | Qualified dividends | Total Capital Gains Distr | Nondividend distributions |

| 2024 | - | - | - | 100% |

| 2023 | - | - | - | 100% |

| 2022 | - | - | - | 100% |

| 2021 | - | - | - | 100% |

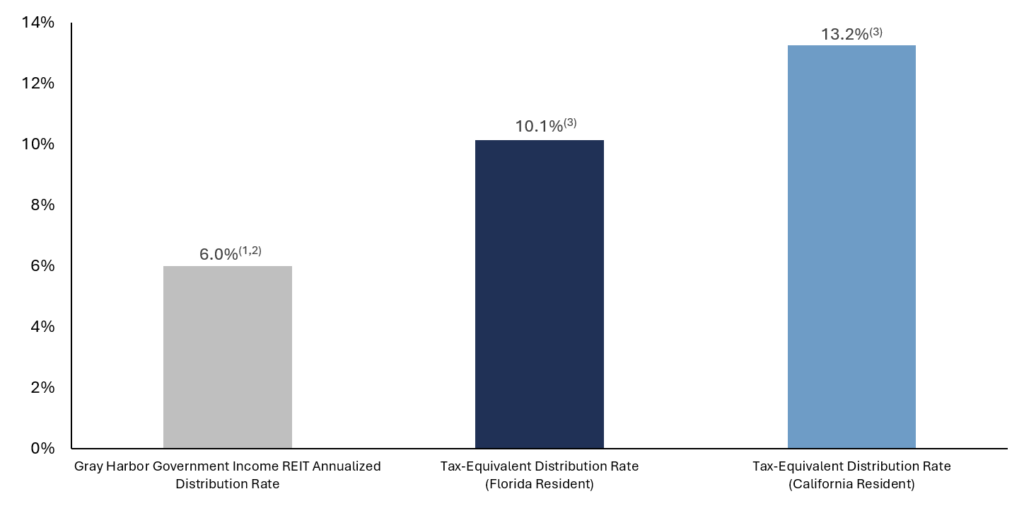

Gray Harbor Government Income REIT Annualized Distribution Rate (1,2,3)

(1) Return of capital distributions reduce an investor’s basis in the year received, generally defer tax liabilities until the underlying position is sold, and an investor may be subject to higher capital gains taxes as a result of a lower cost basis due to the return of capital distributions. Return of capital is only available to the extent an investor has sufficient tax basis. Once all of an investor’s capital has been returned, any additional distributions that are not dividends will be treated as capital gains. While the Gray Harbor Government Income REIT’s current distributions are all classified as return of capital, there is no assurance or guarantee that this classification will continue in future time periods. Items such as depreciation and amortization, which are non-cash items, can reduce taxable income for investors in the Gray Harbor Government Income REIT.

(2) This assumes that Gray Harbor Government Income REIT does not generate taxable income. There is no guaranty that Gray Harbor Government Income REIT’s income will not be taxable income in the future. The tax-equivalent yield refers to the pre-tax distribution rate an investor in a hypothetical taxable investment would need to receive to match the 6.0% after-tax distribution rate of Gray Harbor Government Income REIT’s shares. 100% of the Gray Harbor Government Income REIT’s distributions since inception have been paid as return of capital. Each individual’s tax situation varies. Please seek guidance from a tax advisor. The information presented here should not be construed as investment, legal or tax advice. Return of capital distributions reduce an investor’s basis in the year received, generally defer tax liabilities until the underlying position is sold, and an investor may be subject to higher capital gains taxes as a result of a lower cost basis due to the return of capital distributions. Once all of an investor’s capital has been returned, any additional distributions that are not dividends will be treated as capital gains. While the Gray Harbor Government Income REIT’s current distributions are all classified as return of capital, there is no assurance or guarantee that this classification will continue in future time periods. Items such as depreciation and amortization, which are non-cash items, can reduce taxable income for investors in the Gray Harbor Government Income REIT.

(3) The Tax Equivalent Distribution Rates shown assume a Florida investor who is currently invested in Gray Harbor Government Income REIT with a maximum federal income tax rate of 37%, net investment income tax of 3.8%, and 0% state income tax rate, and a California investor who is currently invested in Gray Harbor Government Income REIT with a maximum federal income tax rate of 37%, net investment income tax of 3.8%, and 14.4% state income tax rate. The ordinary income tax rate, net investment income tax rate, and state income tax rates are subject to change in the future. The illustrative example does not include local taxes. Investors could be subject to local income taxes imposed by their municipalities which could lower the after-tax distribution rate received by the investor. Fixed income investments are not the same as an investment in Gray Harbor Government Income REIT’s shares and may have other advantages, including other tax considerations, and individual investors should consult their tax advisors.

Tax-Efficient Distributions (1)

A significant benefit of Gray Harbor Government Income REIT’s Investment Strategy is its tax-efficiency. Since the launch of the strategy, 100% of all distributions made have been classified as return of capital for income tax purposes. This classification is clearly specified on the 1099-DIVS tax forms investors receive. Because of this, all investors have recognized a maximum tax rate of 0.00%.

Return of capital is only available to the extent an investor has sufficient tax basis.

Return of Capital as % of Total Annual Distributions (1)

Form 1099-DIV Box

2023

Total Ordinary Dividends

–

Nondividend distributions

100%

Form 1099-DIV Box

2022

Total Ordinary Dividends

–

Nondividend distributions

100%

Form 1099-DIV Box

2021

Total Ordinary Dividends

–

Nondividend distributions

100%

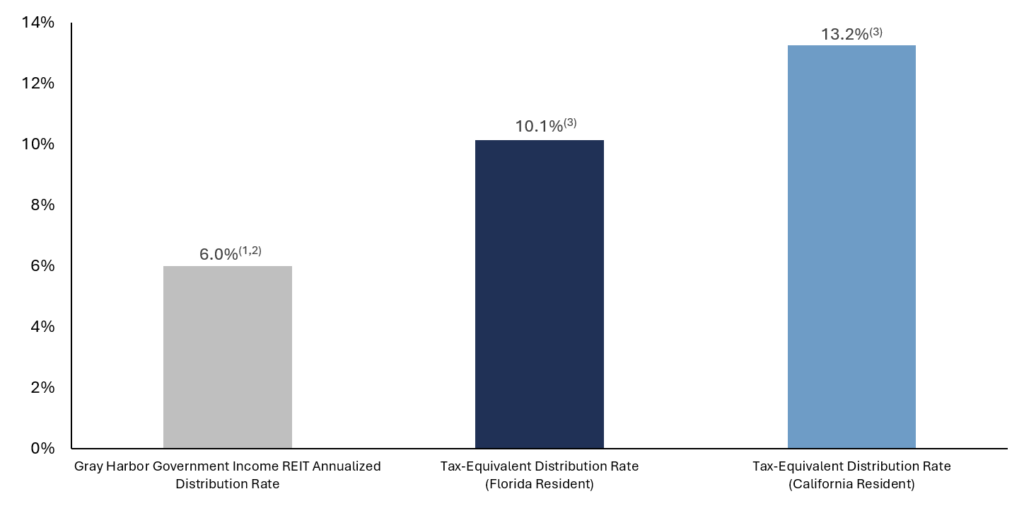

Gray Harbor Government Income REIT Annualized Distribution Rate (1,2,3)

(1) Reflects the current month’s distribution annualized and divided by the prior month’s net asset value, which is inclusive of all fees and expenses. Distributions are not guaranteed and may be funded from the sources other than cash flow from operations.

(2) 100% of Gray Harbor Capital Government Income REIT’s dividend distributions since inception have been paid as return of capital. Each individual’s tax situation varies. Please seek guidance from a tax advisor. The information presented here should not be construed as investment, legal or tax advice. Return of capital distributions reduce an investor’s basis in the year received, and generally defer tax liabilities until the underlying position is sold. Items such as depreciation and amortization, which are non-cash items, can reduce taxable income for investors in the Gray Harbor Capital Government Income REIT. The Tax Equivalent Yield shown assumes a Florida investor who is currently invested in Gray Harbor Capital Government Income REIT with a maximum federal income tax rate of 37%. While Gray Harbor Capital Government Income REIT’s current distributions are all classified as return of capital, there is no assurance or guarantee that this classification will continue in future time periods and 0% state income tax rate” to “and 0% state income tax rate, net investment income tax of 3.8%, and 0% state income tax rate and a California investor who is currently invested in the Gray Harbor Government Income REIT with a maximum federal income tax rate of 37%, net investment income tax of 3.8%, and 14.4% state income tax rate

(3) This assumes that Gray Harbor Government Income REIT does not generate taxable income. There is no guaranty that Gray Harbor Government Income REIT’s income will not be taxable income in the future. The tax-equivalent yield refers to the pre-tax distribution rate an investor in a hypothetical taxable investment would need to receive to match the 6.0% after-tax distribution rate of Gray Harbor Government Income REIT’s shares. 100% of the Gray Harbor Government Income REIT’s dividend distributions since inception have been paid as return of capital. Each individual’s tax situation varies. Please seek guidance from a tax advisor. The information presented here should not be construed as investment, legal or tax advice. Return of capital distributions reduce an investor’s basis in the year received, and generally defer tax liabilities until the underlying position is sold and an investor may be subject to higher capital gains taxes as a result of a lower cost basis due to the return of capital distributions. Items such as depreciation and amortization, which are non-cash items, can reduce taxable income for investors in the Gray Harbor Government Income REIT. The Tax Equivalent Yield shown assumes a Florida investor who is currently invested in Gray Harbor Government Income REIT with a maximum federal income tax rate of 37%, net investment income tax of 3.8%, and 0% state income tax rate and a California investor who is currently invested in Gray Harbor Government Income REIT with a maximum federal income tax rate of 37%, net investment income tax of 3.8%, and 14.4% state income tax rate. While the Gray Harbor Government Income REIT’s current distributions are all classified as return of capital, there is no assurance or guarantee that this classification will continue in future time periods. The ordinary income tax rate is subject to change in the future. The illustrative example does not include local taxes. Investors could be subject to local income taxes imposed by their municipalities which could lower the after-tax distribution rate received by the investor. Fixed income investments are not the same as an investment in Gray Harbor Government Income REIT’s shares and may have other advantages, including other tax considerations, and individual investors should consult their tax advisors. Once all of an investor’s capital has been returned, any additional distributions that are not dividends will be treated as capital gains.