Who Is Gray Harbor Capital?

Gray Harbor Capital, LLC, is a boutique investment management firm that specializes in single-tenant federal government leased real estate. Gray Harbor Government Advisors, LLC, is wholly owned by Gray Harbor Capital, LLC, and serves as Advisor to Gray Harbor Government Income REIT.

Strategy

Gray Harbor Government Income REIT’s investment strategy focuses exclusively on acquiring, managing, and developing properties leased to the federal government and backed by the full faith and credit of the United States of America. It seeks to deliver superior risk-adjusted returns through a diversified portfolio of properties that has the same underlying credit exposure as U.S. Treasuries (via single-tenant leases with federal government agencies); targets better than equity performance (via NAV growth and shareholder distributions); and produces uncorrelated returns versus other asset classes.

To accomplish this, our team targets property acquisitions and development projects that meet the specific needs and requirements of politically agnostic, specialized agencies that have enduring missions critical to our country’s national security, infrastructure, and essential services. We construct the portfolio by diversifying across lease terms, federal agencies, lease generations, locations, and size. We focus on secondary and smaller markets where the Federal Government prefers leasing over direct ownership, and where demographics support the long-term need for tenant agencies.

The primary objective of the strategy is total return. Supplemental objectives include providing our investors with capital preservation, current yield, uncorrelated monthly returns, tax-efficiency, inflation protection, and long-term wealth creation.

There can be no assurance these objectives will be achieved.

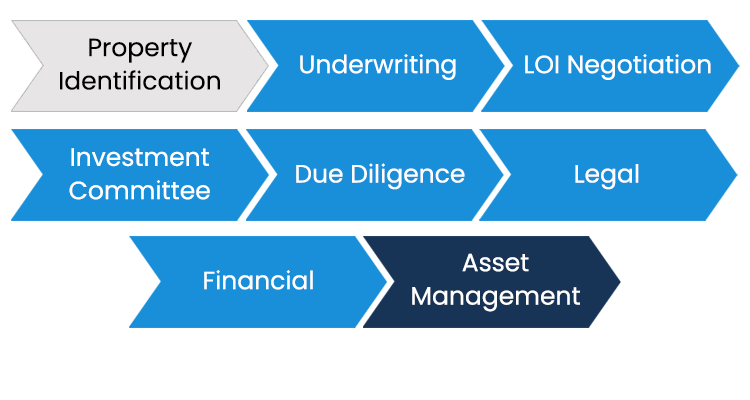

Process

Source

Acquire

Manage

Who Is Gray Harbor Capital?

Gray Harbor Capital, LLC, is a boutique investment management firm that specializes in single-tenant federal government leased real estate. Gray Harbor Government Advisors, LLC, is wholly owned by Gray Harbor Capital, LLC, and serves as Advisor to Gray Harbor Government Income REIT.

Strategy

Gray Harbor Government Income REIT’s investment strategy focuses exclusively on acquiring, managing, and developing properties leased to the federal government and backed by the full faith and credit of the United States of America. It seeks to deliver superior risk-adjusted returns through a diversified portfolio of properties that has the same underlying credit exposure as U.S. Treasuries (via single-tenant leases with federal government agencies); targets better than equity performance (via NAV growth and shareholder distributions); and produces uncorrelated returns versus other asset classes.

To accomplish this, our team targets property acquisitions and development projects that meet the specific needs and requirements of politically agnostic, specialized agencies that have enduring missions critical to our country’s national security, infrastructure, and essential services. We construct the portfolio by diversifying across lease terms, federal agencies, lease generations, locations, and size. We focus on secondary and smaller markets where the Federal Government prefers leasing over direct ownership, and where demographics support the long-term need for tenant agencies.

The primary return objective of the strategy is total return. Supplemental objectives include providing our investors with capital preservation, current yield, uncorrelated monthly returns, tax-efficiency, inflation protection, and long-term wealth creation.

There can be no assurance these objectives will be achieved.

Process

Source

Acquire

Manage

Benefits of Investing in Federal Government Leased Real Estate

Portfolio Construction

Gray Harbor Government Income REIT’s portfolio construction process draws from the investment team’s 125+ collective years of experience in the federal-government leased real estate sector. Through this experience, the investment team has identified specific property, lease, and market characteristics that are incorporated into Gray Harbor Government Income REIT’s portfolio construction process to seek to achieve its investment objectives.

There can be no assurance these objectives will be achieved.

Facility Characteristics

Focused Strategies

Market Characteristics

Portfolio Construction

Gray Harbor Government Income REIT’s portfolio construction process draws from the investment team’s 125+ collective years of experience in the federal-government leased real estate sector. Through this experience, the investment team has identified specific property, lease, and market characteristics that are incorporated into Gray Harbor Government Income REIT’s portfolio construction process to seek to achieve its investment objectives.

There can be no assurance these objectives will be achieved.

Facility Characteristics

Focused Strategies

Market Characteristics

Benefits of Investing in Federal Government Leased Real Estate

High Quality Credit

Leases are backed by the full faith and credit of the United States of America

Niche & Specialized Investment Strategy

Provides investors with a differentiated investment offering and a unique exposure for their portfolios.

Contractual and Durable Income Stream

Our tenants are backed by the United States of America providing investors comfort regarding rent collection versus other areas of commercial real estate.

Highly Fragmented Industry

The largest owner of federally leased assets owns just over 5% of the total market.

Highly Financeable

Financing is strong for government leased properties given the quality of the underlying tenant.