Gray Harbor Government Income REIT

Real Estate with Leases Backed by the Full Faith & Credit of the United States of America

Gray Harbor Government Income REIT

Real Estate with Leases Backed by the Full Faith & Credit of the United States of America

Investment Objective

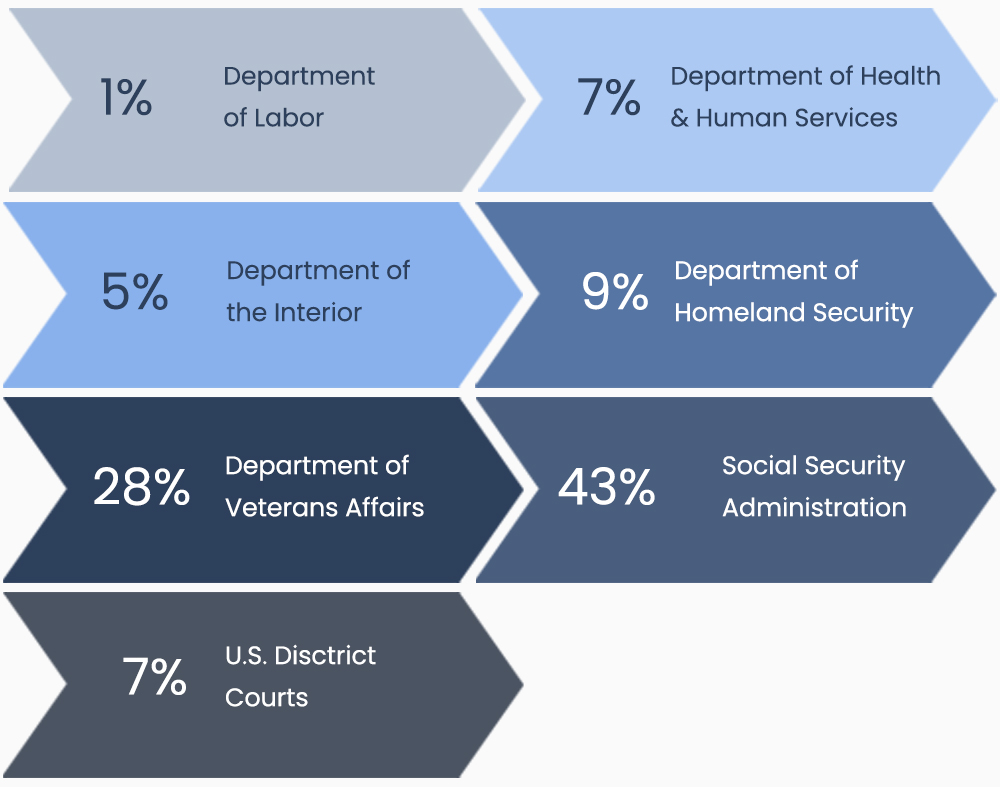

Gray Harbor Government Income REIT acquires, develops, and manages federal government leased properties. It seeks long-term growth of capital and tax-deferred, stable income by focusing on single-tenant properties leased to federal agencies backed by the full faith and credit of the United States of America. Its portfolio of real estate includes properties leased to taxpayer-facing, mission-critical, and essential service federal agencies located throughout the United States.

There can be no assurance these objectives will be achieved.

Five Key Benefits

Gray Harbor Government Income REIT seeks to provide investors with a differentiated investment solution. We aim to achieve superior risk-adjusted returns as a standalone investment strategy, or as a compelling diversifier to an investor’s overall investment portfolio. We do this by managing the portfolio to deliver on the following five goals, which we believe makes Gray Harbor Capital Income REIT a unique investment offering.

U.S. Government Credit Risk

We focus 100% on single-tenant properties with leases signed and backed by the United States of America.

U.S. Equity-like Returns

We seek to deliver long-term capital growth and an annual 6% distribution to meet or exceed historical stock market returns over rolling five-year periods.

Low Volatility

Our consistent monthly performance is primarily supported by dividends generated from the durable cash flow of lease payments from the federal government.

Five Key Benefits

Gray Harbor Government Income REIT seeks to provide investors with a differentiated investment solution. We aim to achieve superior risk-adjusted returns as a standalone investment strategy, or as a compelling diversifier to an investor’s overall investment portfolio. We do this by managing the portfolio to deliver on the following five goals, which we believe makes Gray Harbor Capital Income REIT a unique investment offering.

U.S. Government Credit Risk

We focus 100% on single-tenant properties with leases signed and backed by the United States of America.

U.S. Equity-like Returns

We seek to deliver long-term capital growth and an annual 6% distribution to meet or exceed historical stock market returns over rolling five-year periods.

Low Volatility

Our consistent monthly performance is primarily supported by dividends generated from the durable cash flow of lease payments from the federal government.

Real Estate

Gray Harbor Government Income REIT owns a portfolio of high-quality, tax-efficient, income-producing real estate diversified by geography, size, lease-term, and federal agency tenant.

100%

of Gray Harbor Government Income REIT’s portfolio is composed of federal government leased properties.

This material contains forward-looking statements. These forward-looking statements can be identified by the use of forward-looking terminology such as “believes,” “expects,” “potential,” “continues,” “identified,” “may,” “will,” “should,” “intends,” “plans,” “estimates,” “anticipates”, “confident,” “conviction” or other similar words or the negatives thereof. These may include financial estimates and their underlying assumptions, statements about plans, objectives, intentions, and expectations with respect to positioning, including the impact of macroeconomic trends and market forces, future operations, acquisitions, and future performance. Such forward-looking statements are inherently subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in such statements. Except as otherwise required by federal securities laws, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future developments or otherwise.

100%

of Gray Harbor Government Income REIT’s portfolio is composed of federal government leased properties.

This material contains forward-looking statements. These forward-looking statements can be identified by the use of forward-looking terminology such as “believes,” “expects,” “potential,” “continues,” “identified,” “may,” “will,” “should,” “intends,” “plans,” “estimates,” “anticipates”, “confident,” “conviction” or other similar words or the negatives thereof. These may include financial estimates and their underlying assumptions, statements about plans, objectives, intentions, and expectations with respect to positioning, including the impact of macroeconomic trends and market forces, future operations, acquisitions, and future performance. Such forward-looking statements are inherently subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in such statements. Except as otherwise required by federal securities laws, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future developments or otherwise.